What Is an Inverted Yield Curve? Why Everyone Is Panicked About it.

I recently explained why the yield curve inverting is an important signal and why many investors may be misinterpreting this signal. I highlighted the significance of the brief yield curve inversion for equities and what role unusual inflation expectations may have had in its occurrence. As the Federal Reserve and Chairman Powell have begun to provide signals that they are about to begin a tighter monetary policy to combat recent inflation readings that have been rising, the “the yield curve” has started receiving more and more attention from the financial press, economists, and other Wall Street talking heads. For many not working in the financial markets, the phrase yield curve and related concepts can be confusing. Thus, we wanted to provide subscribers a brief primer to make sure you understand what it is, why you are hearing so much about it, and why it can provide useful signals for the economy, sector positioning, and individual stocks.

You’ve probably heard in the financial media that the yield curve briefly inverted yesterday. Normally, longer-dated maturities have higher rates because the chance of repayment is lower the more time debt is outstanding, as more can go wrong. An inversion of the yield curve means at least one longer-dated maturity has a lower yield than a shorter-dated maturity. So, when the 2-year yield is higher than the 10-year yield, this can suggest abnormal volatility or headwinds for growth are ahead in the short term. In normal times, longer-dated maturities should have higher yields.

The Yield Curve refers to the term structure of US government debt. Term structure simply refers to the rates of bonds of similar or the same quality across different maturities, either in a table or a graph. Since the risk-free rate (or what you could earn on your money without taking risk) is a vital component of many valuation methods, the proxy for this rate is incredibly important for financial markets. Since US government debt is considered the world’s safest asset, various maturities of US debt assume this vital function for many different types of valuation models for both equities and derivatives.

Very simply put, the yield curve shows yield as a function of maturity for debt instruments. On a graph, the yield curve has maturity on the x-axis and yield on the y axis. The yield on the 10-yr treasury can be thought of as the yield on the 1-yr note, plus nine years of the expected rate. Thinking of the curve in this way can help interpret the signal this vital indicator can provide.

The yield curve can be confusing but I want to give you a brief primer to make sure you understand what it is and why it can provide a valuable signal for stocks. You’ve probably heard in the financial media that the yield curve briefly inverted yesterday. This always gives the top-calling crowd ample ammunition, and many will tell you the yield curve inversions are a leading indicator that predicts recessions.

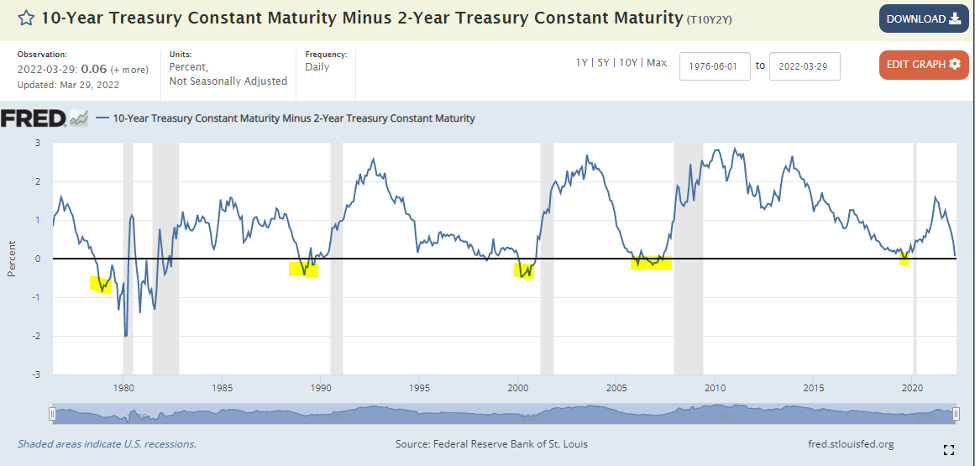

The chart below shows how when the spread between the 2 years and 10 years (a.k.a. the “2s10s spread”) has inverted, it has indeed presaged past recessions. For this reason, when inversions occur, they are considered a “death touch” for economic expansions. Therefore, the inversion of this crucial indicator gets a lot of attention when it happens. However, it is also helpful to remember that inversions of the 2s10s spread, in particular, have been overly sensitive and have “predicted” 10 of the last 6 recessions since 1976. Inversions are highlighted below in yellow.

There is disagreement amongst those in the know just exactly why this inversion has predictive value. Purists contend that markets are efficient and provide better information than any one of us can on our own. Some will even claim that the yield curve accurately predicted the recession caused by COVID-19. We find this somewhat unlikely and think there’s a more nuanced reason why the curve inverts and why this can often signal upcoming trouble for financial markets.

Some believe the curve predicts Fed efforts to tighten and rein in inflation. The correlation to economic outcomes is coincidental. Instead, they believe the power of the yield curve is to predict the Fed Policy Cycle. However, the economic significance of the Federal Reserve explains why the indicator seems to presage recessions. In My In Summary in my humble opinion: It is not the recession being predicted but aggressive Fed action that has a high likelihood of potentially causing a recession.