The Bond Market Called Inflation Right in 2022

In 2022, the bond market called the Fed actions well ahead of the Fed. And if this carries into 2023, the bond market says the Fed will soon turn dovish. That is good news for equities.

The bond market called Fed right in 2022 and now says Fed will be dovish in 2023… even if Fed doesn’t know it yet

James Carville once famously said in the next life he wants to be reborn as the bond market (because it scares everyone). And this year, the bond market again proved its storied ability to see the economy’s future path, well before equity markets and the Fed.

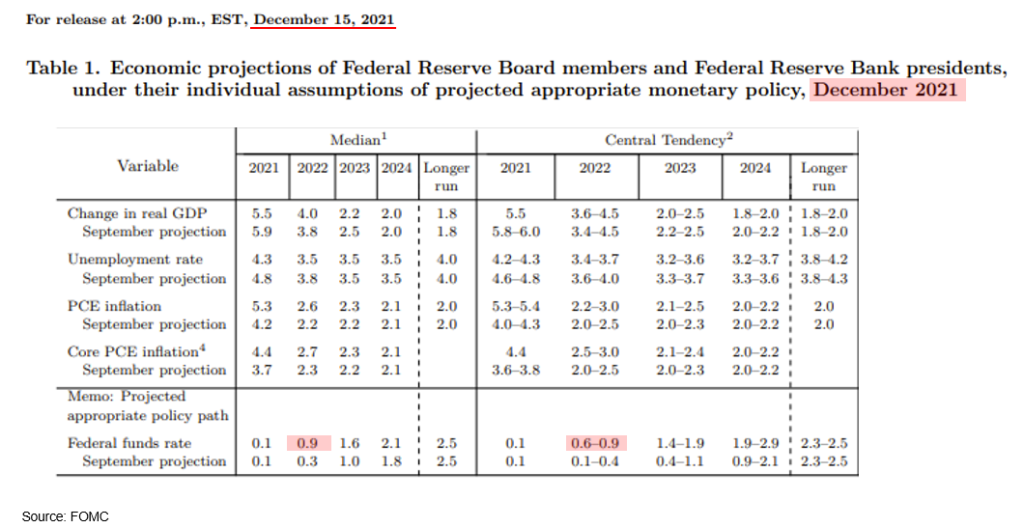

Take a look at the Fed’s forecast for Fed funds from its December 2021 SEP (Summary Economic Projections):

- FOMC anticipated YE 2022 Fed Funds of 0.9%, or 80bp of hikes in 2022

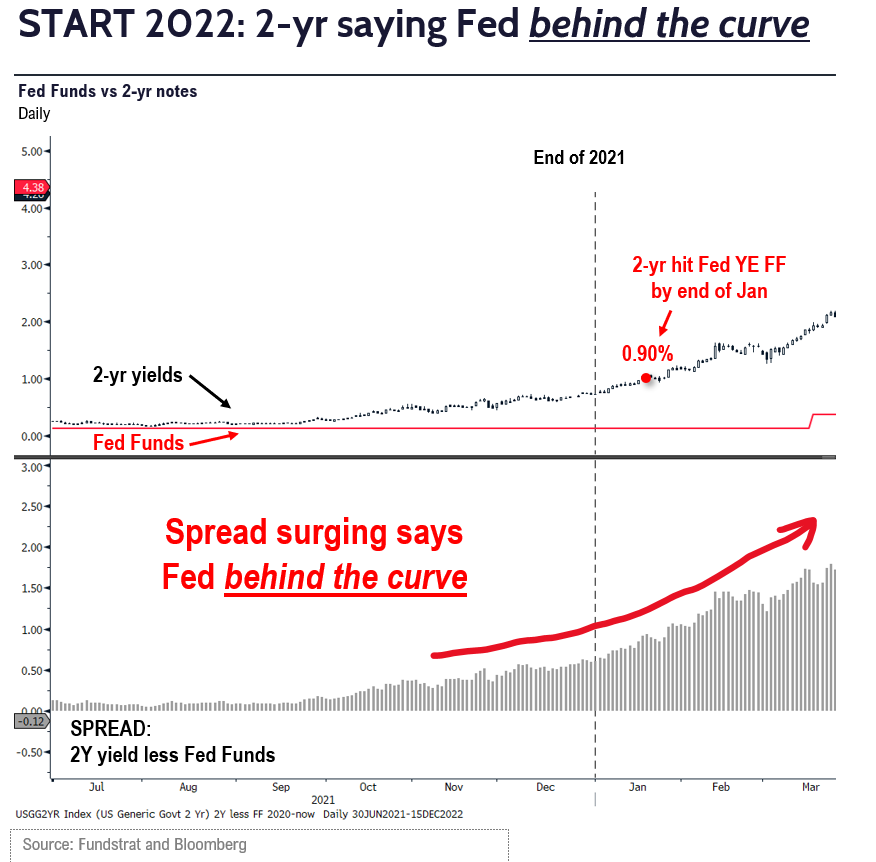

But by January 2022, the 2-yr yield (a proxy for where markets see Fed funds heading) was already at 0.90%.

- 2-yr screamed Fed was behind the curve by January 2022

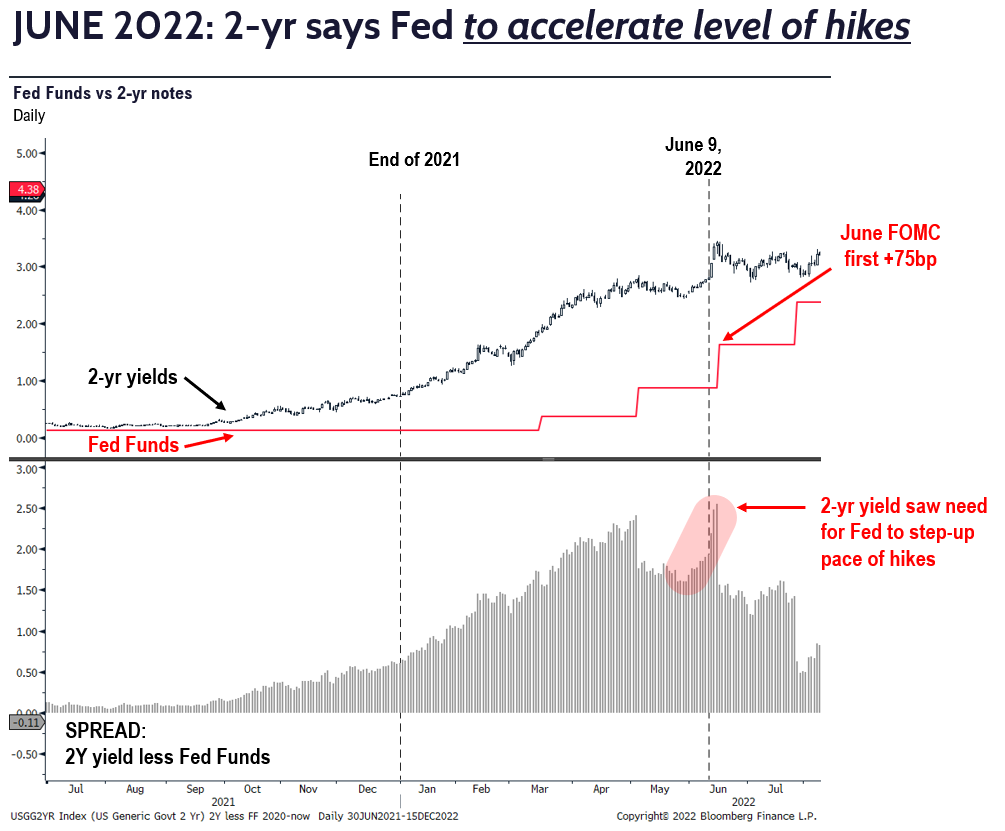

Bond market anticipated Fed would need to drastically step up pace of hikes to +75bp by June9th

And by early June, the 2-yr said Fed needed to step up the pace of hikes:

- notice the spread 2Y less FF jumped on June 9th

- this is right before Fed stepped up hikes to +75bp

- Nick Timiraos of WSJ wrote his +75bp article on June 12th, 3 days after the bond market priced in +75bp

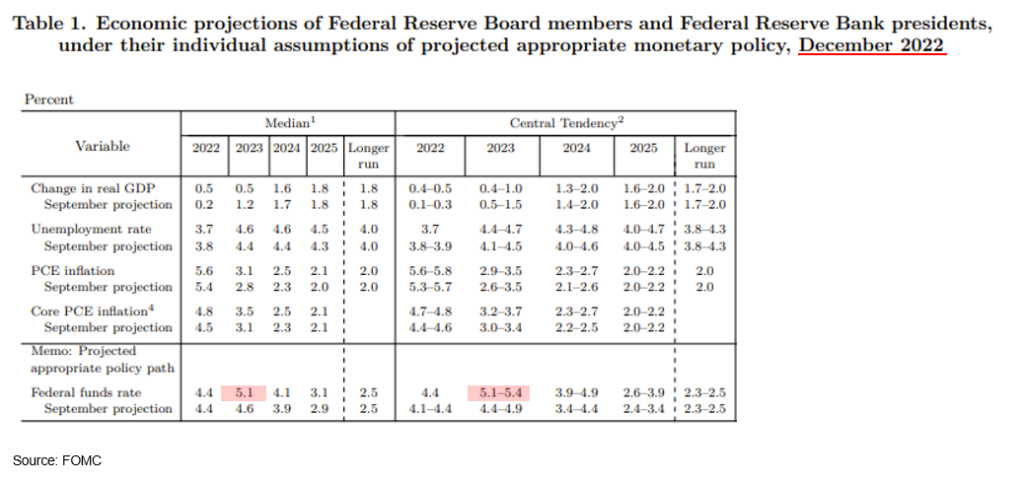

December 2022 FOMC Fed sees FF at 5.1% by YE 2023…

The latest FOMC dot plot (12/14/2022) sees Fed Funds at 5.1% by YE 2023.

- Current Fed Funds is 4.375%

- This implies about +72bp of hikes in 2023, or 3 hikes

2-year says Fed will cut rates in 2023

As we enter 2023, the 2-yr says Fed will make a dovish turn.

- 2-yr is 4.2%

- BELOW current Fed funds of 4.375%

- Well BELOW the FOMC dot plot of 5.1%

- In short, the bond market is more dovish than the Fed

In 2022, the bond market called the Fed actions well ahead of the Fed. And if this carries into 2023, the bond market says the Fed will soon turn dovish. That is good news for equities.