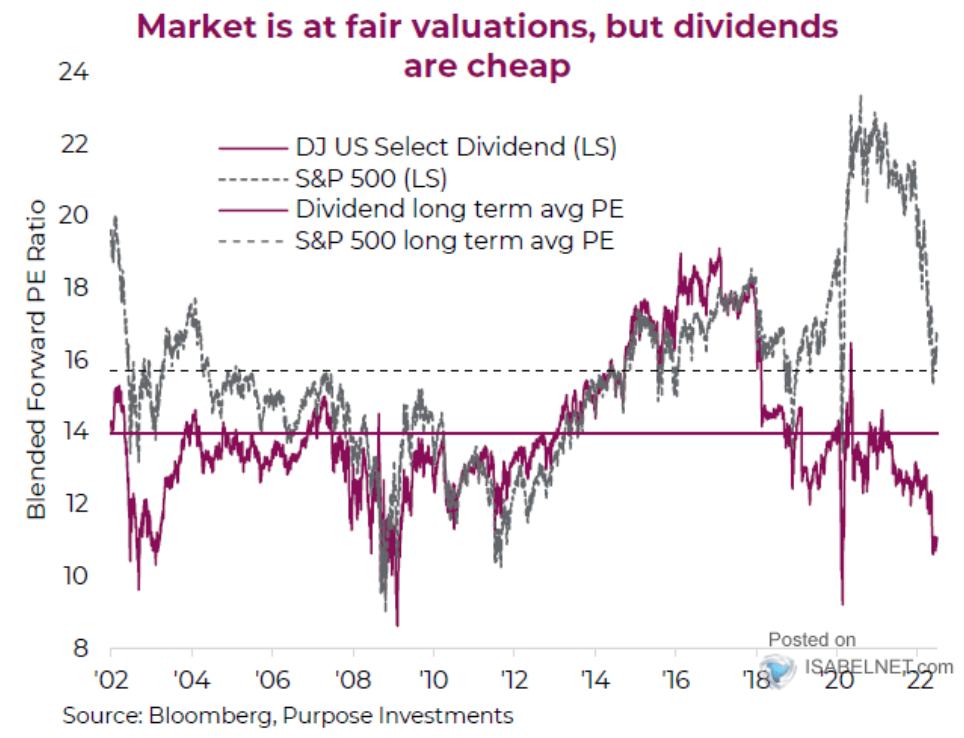

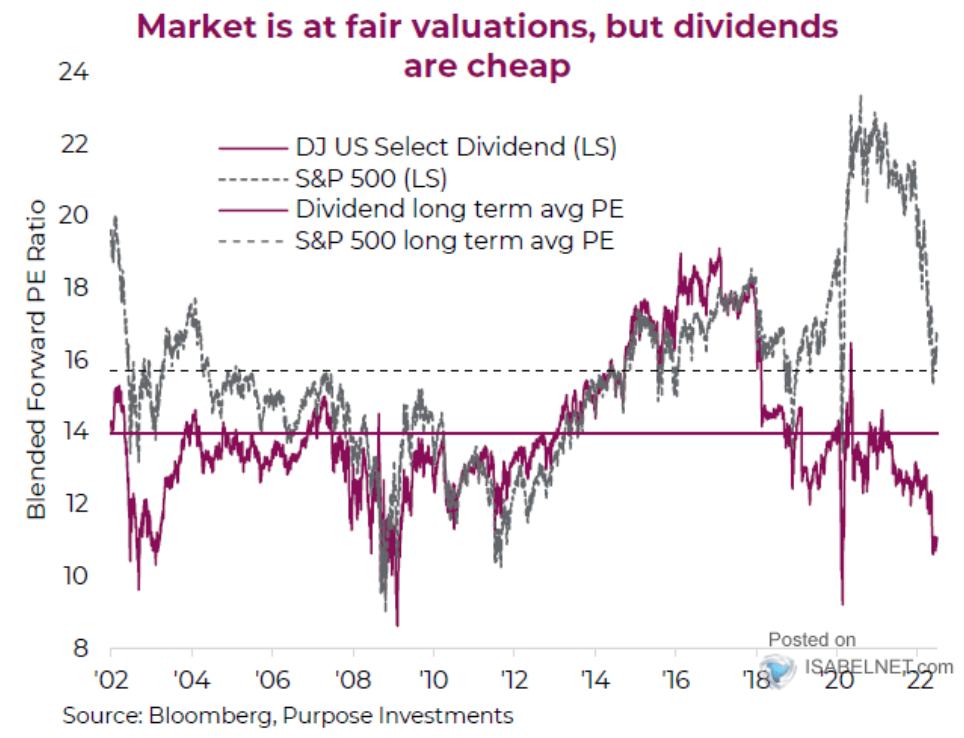

For the first time in 18 months, over 90% of the S&P 500 is over its 50-day moving average. The whole index now sits right below its 200-day average. An interesting perspective on this recovery of the last month or so: Large-cap value has recovered 63% of what it was down (which itself was only half of what Largecap growth was down)Large-cap growth has recovered 46% of what it was down bitcoin has recovered 14.5% of what it was down even with a +22.8% rally in the Nasdaq, it has only recovered 44% of the -34% drawdown it previously experienced ten-year bond yield closed today at 2.79%, down -5.5 basis points on the day Top-performing sector for the day: Consumer Staples (+1.05%)Bottom-performing sector for the day: Energy (-1.98%)The S&P is trading a bit over 17x forward earnings (vs. a historical average of 16x, and assuming the current earnings estimate around $250/share across the cap-weighted index is correct – which I most certainly do not assume). But I should point out, that despite a massive outperformance this year of dividend stocks over the broad market, the dividend stock index trades at a substantial discount to its historical valuation level. |