Historically, July/August are not Months to “be a hero in the Stock Market”

The chop was most evident in this violent sector rotation. In my opinion, people “made less money” in July/August, and thus, I view this two-month period as one where investors should not try to be a “hero” — this is in part due to reduced market liquidity:

– many investors take a vacation in July/August

– this equates to a “buyers strike” and thus, tape bombs can roil markets

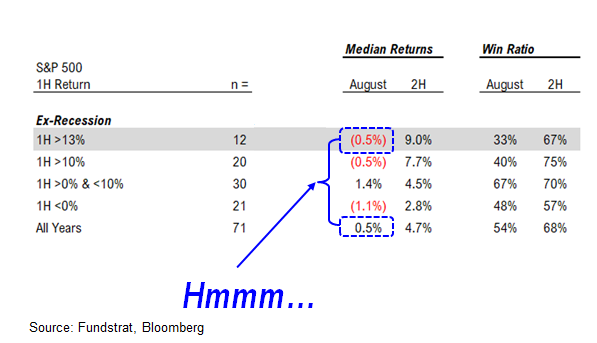

– Since 1900, during the 12 periods when 1H gains >13%, you can see July/August “chop” is the baseline

– “don’t be a hero” means generally avoiding leverage and short-term options

– term premia get eaten up during “chop”

– when S&P 500 >13% 1H, August return -0.5%

– For the last 10 years, August return has been +0.5% in average

So August base case would argue to be “cautious” — but for reasons discussed, I think this will not come into play as strongly.